operating cash flow ratio negative

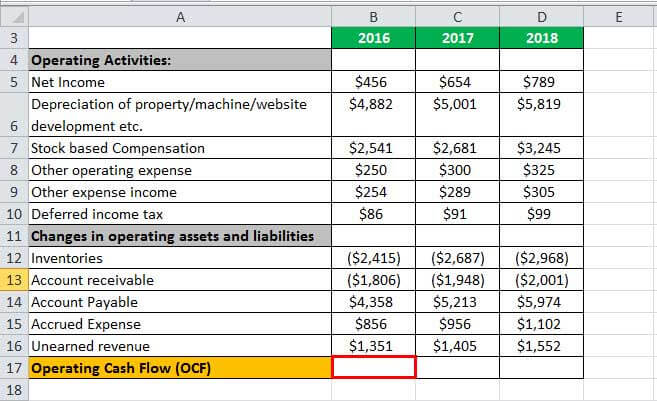

Negative operating cash flow is a situation in which a company or business does not have access to the necessary funds when they are needed to meet expenses. Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and.

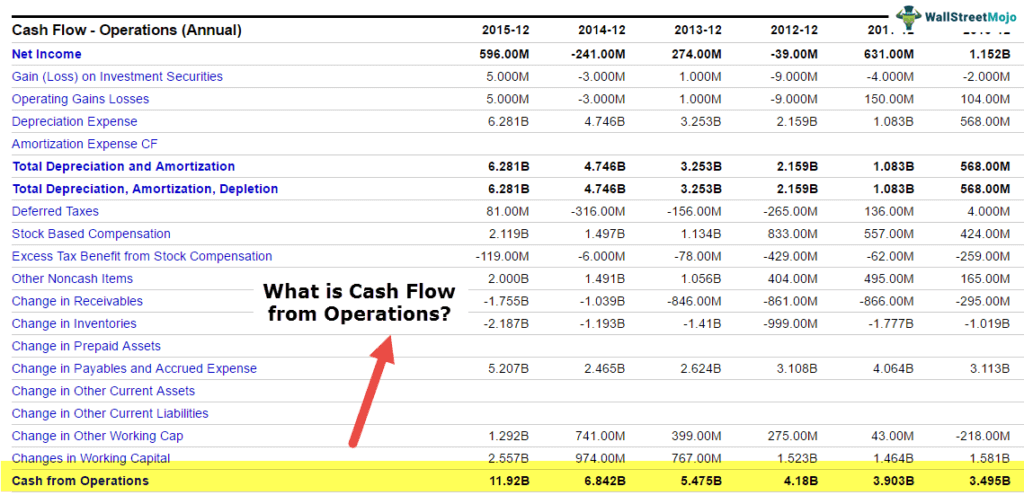

Understanding Cash Flow From Operating Activities Cfo Dr Vijay Malik

This signals short-term problems and a need for more Cash.

. Negative operating cash flows can only occur when 1 the companys net income was negative in the first place or 2 when the firm faced a substantial increase in its working. When the ratio is low or negative it could be an indication that the company needs to adjust its operations and start figuring out which activities are sinking its income or. Interpretation of Operating Cash Flow Ratio.

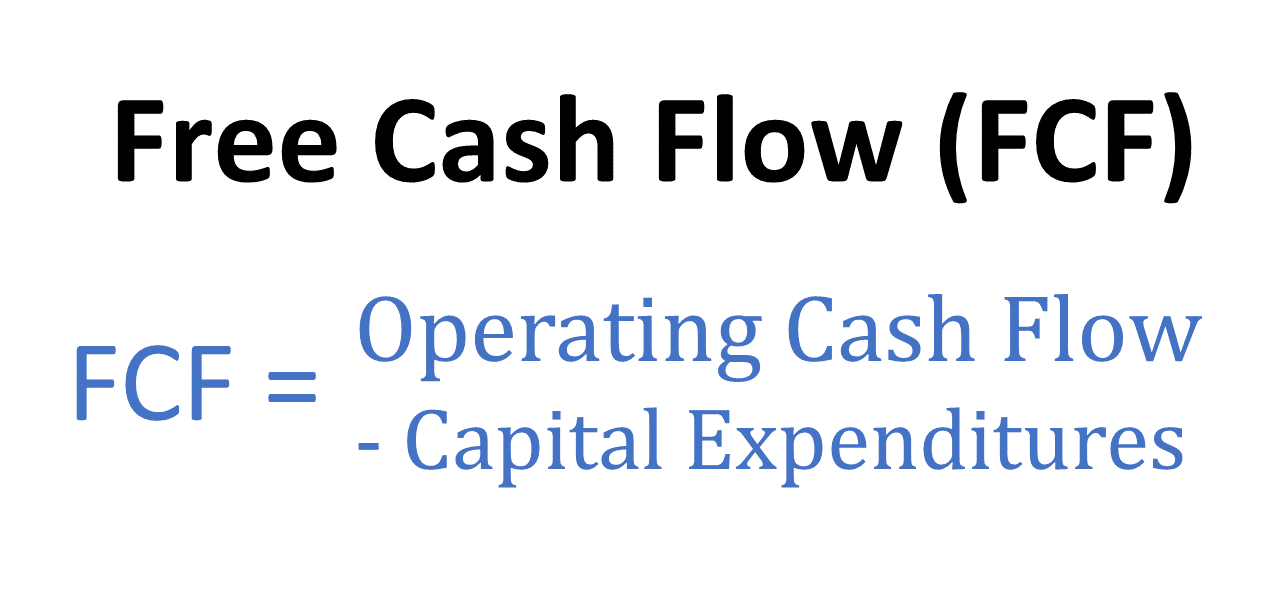

Instead you need money from. The two primary drivers for the negative investing activities. We can see that net cash used in investing activities was -1859 billion for the period highlighted in green.

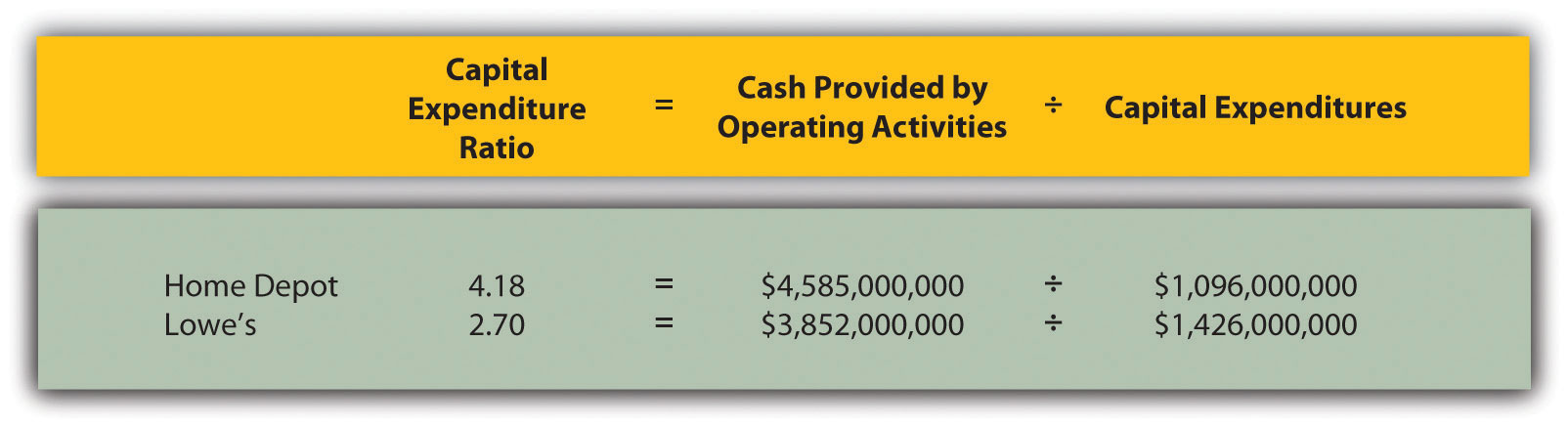

Negative cash flow is when your business has more outgoing than incoming money. Operating Cash Flow Margin Conclusion Operating cash flow margin is a measure of the cash a company makes from its operations as a percentage of its net sales. An operating cash flow ratio of less than one indicates the oppositethe firm has not generated enough cash to cover its current liabilities.

OCF is equal to Total revenue minus. The formula to calculate the ratio is as follows. Operating cash flow indicates.

As mentioned before negative cash flow means that your business is spending more money than it receives. Though negative cash flow is not inherently bad this financial. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations.

In the second scenario above because the operating profit is negative the profit margin percentage will be negative. Operating Cash Flow Margin. To investors and analysts a low ratio.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. A ratio less than ONE indicates short-term cash flow problems. This method is very simple and accurate.

Dividing -50000 by 500000 to get -01 or -10. A ratio greater than. Operating Cash Flow - OCF.

A key advantage of the operating cash flow ratio is that cash flows are generally considered to be a better indicator of financial condition than a firms reported profits. But as it does not provide much detailed information to the investor companies use the indirect method of OCF. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

The detailed operating cash flow formula is. You cannot cover your expenses from sales alone.

What Does A Negative Operating Cash Flow Mean Cliffcore

Net Cash Flow Formula Calculator Examples With Excel Template

Operating Cash Flow Ratio Definition And Meaning Capital Com

Operating Cash Flow Formula Calculation With Examples

Cash Flow It S Not The Bottom Line

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Operating Cash Flow Efinancemanagement Com

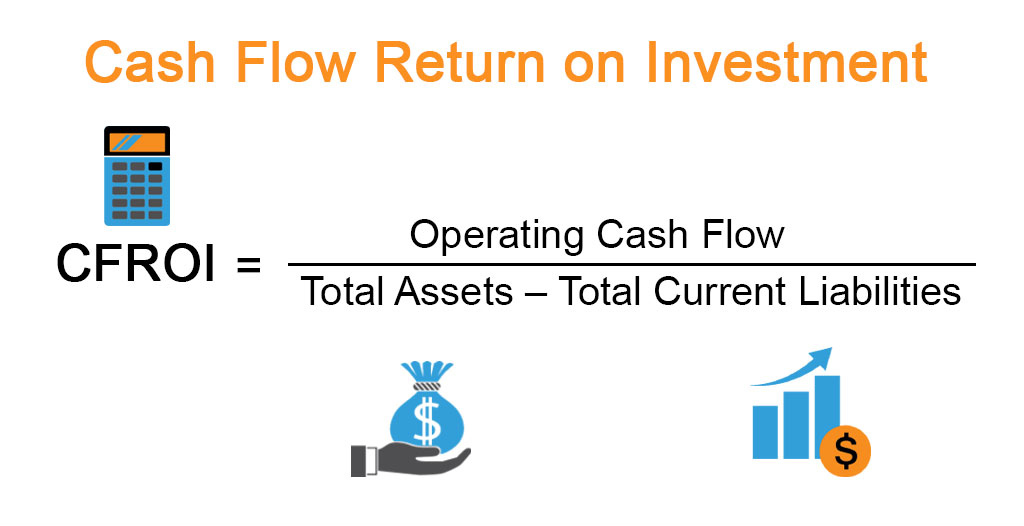

Cash Flow Return On Investment Examples With Excel Template

How Is The Statement Of Cash Flows Prepared And Used

Operating Cash Flow Formula Calculation With Examples

How To Understand Operating Cash Flow Ratio Youtube

Financial Management Every Business Should Know Bubblebulb

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Free Cash Flow Fcf Definition Formula And How To Calculate Stock Analysis

What Is Operating Cash Flow Ratio Accounting Capital

Negative Working Capital What Is Negative Nwc

Negative Cash Flow Investments In Companies